Moreover, IBKR does not invest client funds in money market funds, despite the CFTC’s approval, due to credit worries over foreign sovereign debt. IBKR client funds are kept separate in special bank or custody accounts set up only for the benefit of IBKR customers. This safeguard (referred to as “reserve” by the Securities and Exchange Commission (SEC) and “segregation” by the Commodity Futures Trading Commission (CFTC) is a fundamental premise of the securities and commodities brokerage industries. IBKR provides one of the largest Mutual Fund Marketplaces internationally, with over 40,000 funds from 400 fund families, including 7,700 with no transaction costs.

How This Broker Makes Money From You and For You

Clients of IBKR Pro have access to the IB SmartRoutingSM technology, which gives a $0.47 per 100 share price improvement above the market average compared to the industry. Event contracts provide a means for you to predict whether the price of futures markets will rise or fall by the end of each day’s trading period. These contracts are available for various futures markets, including equity index, energy, metals, and foreign currency, all of which are listed on CME. The broker’s TWS API is well-supported, and there are various examples to assist you in getting started. In addition to monitoring quotes and conducting trades, the firm’s online client portal provides access to viewing account balances, profit and loss statements, key performance metrics, financing, reporting, among other functions.

What should beginners look for in a quality stock broker?

IB Trader Workstation offers a ton of information and tools that are excellent for institutional and highly experienced investors but that may come with a bit of a learning curve. While they offer a demo account if you’d like to test it, beginner and recreational investors still may find all of the information overwhelming. Additionally, the organization provides client coverage, its funds are effectively handled, account protection, mobile two-factor authentication, withdrawal limitations, and a digital security card. The Secure Login System adds an additional layer of protection to your account; customers can use a free physical security device or IBKR Mobile Authentication (the broker’s smartphone security app). While it may add an additional step to signing in, inputting a randomly generated security code with your username and password helps enormously safeguard your account. Client securities accounts at Interactive Brokers are covered up to $500,000 by SIPC (with a cash sub-limit of $250,000).

- While Pro account holders will receive access to a wide range of indicators and software, Lite stock traders also receive a full suite of trading tools.

- Likewise, for its currency conversion – which allows you to convert your account balance from one currency to another – the same process applies.

- He holds a Bachelor’s Degree in English Literature from San Francisco State University, and conducts research on forex and the financial services industry while assisting in the production of content.

- Interactive Brokers has established a reputation for offering low fees and commissions.

Interactive Brokers Pros and Cons

Fido’s app will satisfy almost every long-term investor, but I think its logical layout makes it easier for beginning investors to find useful insights into the markets and their holdings. Finally, for those investors who have outgrown the capabilities provided by their current broker or who anticipate doing so in the near future, Interactive Brokers may be a sensible alternative to help you take your trading to the next level. Customers can try the broker’s platforms risk-free and compare their commissions, margins, and cheap financing costs to those of their existing broker.

Interactive Brokers is to investors what Disneyland is to little kids: a playground for the imagination

For this guide to the best stock apps, we thoroughly tested key features including the availability and quality of watch lists, charting, real-time and streaming quotes, stock alerts, and educational resources, among other variables. We also look for a fluid user experience moving between mobile and desktop platforms, where offered. Our writers maintained active, funded online brokerage accounts for testing.

Bad experience when transferring money…

Use the broker comparison tool to compare over 150 different account features and fees. Nonetheless, the company provides various instructional resources that consumers may employ to achieve their financial goals. Clients can earn up to 4.58% interest on unspent cash balances in their securities accounts, which accrues and is payable daily. From your iOS or Android device, you may easily trade and manage your IBKR account while on the road (tablet or smartphone), and users can download the application from the App Store or Google Play. The Bond Marketplace offers a broad range of global fixed-income securities.

Our editors independently research and recommend the best products and services. You can learn more about our independent review process and partners in our advertiser disclosure. It has over $9 billion in equity capital, has more than a million client accounts in more than 200 countries and territories and executes about 2.5 million trades per day. IBKR competes aggressively on price and is often among the lowest-cost brokers in several areas, especially in margin rates and cryptocurrency trading. Money held in an investment account with Interactive Brokers in the U.S. is protected by SIPC insurance, which covers up to $500,000 in securities and up to $250,000 in cash. If you hold more than $250,000 in cash, Interactive Brokers offers a Insured Bank Deposit Sweep Program, which provides up to $2.5 million in FDIC insurance in addition to the SIPC insurance.

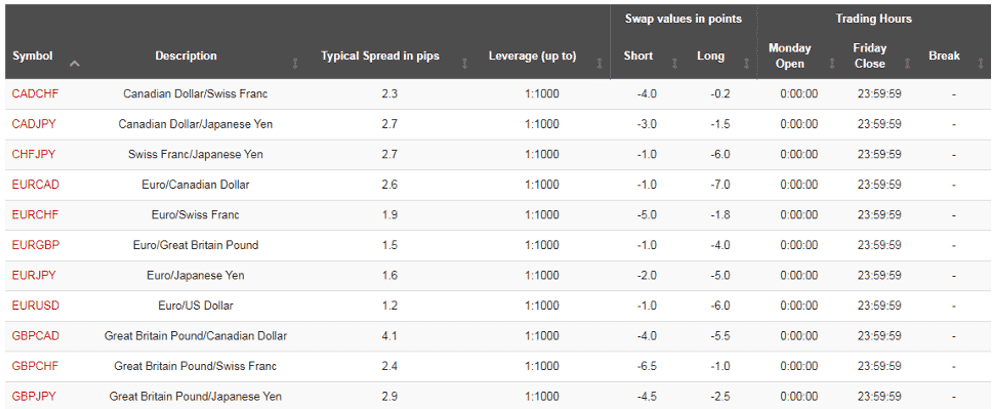

Meanwhile, because it targets professional and institutional investors, IBKR Pro charges commissions, offering both fixed and tiered pricing options. Under the fixed pricing system, you owe $0.005 per share for stock trades, with a minimum fee of $1 and maximum of 1% of the total trade value. Those making a large volume of trades per month could switch to the firm’s tiered pricing system, where the fee decreases as your total trading volume gets larger. Interactive Brokers similarly uses both fixed and tiered commission systems for other investments like options, bonds, forex and mutual funds. J.P Morgan’s Self-Directed Investing platform is a good fit for existing Chase customers who are looking for a low-cost way to trade stocks, ETFs and mutual funds while getting access to the bank’s easy-to-use mobile app.

More experienced investors may be disappointed by the lack of options or mutual fund trading and a limited research offering. Interactive Brokers just hits the industry standard options pricing of $0.65 per contract. Not bad, surely, but other brokers offer better non-discounted pricing with no or little volume (not counting the free apps). For example, Ally Invest charges just $0.50 per contract, while E-Trade charges $0.50 a contract interactive brokers forex review if you make 30 trades per quarter, not exactly high volume. Rival tastytrade also offers highly competitive pricing on options trades, too, with non-discounted prices starting at an all-in cost of $0.50 and falling quickly from there. If you’re running mammoth-sized trades (think 300,000 shares and up each month), then you’ll benefit from the broker’s tiered pricing, where commissions reach less than 10 percent of the half-penny rate.

Interactive Brokers maintains high security standards for both desktop and mobile services, including two-factor authentication. We recommend comparing brokerage options to ensure the account you’re selecting is the best fit for you. To make your search easier, here’s a short list of our best trading platforms of 2024.

Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers. Bankrate follows a strict editorial policy, so you can trust that we’re putting your interests first. Those who participate will be able to leverage their understanding of the financial markets to explore how a parallel market may influence, or be influenced by, that asset class in which they have familiarity. IBKR has technology that can take your market expectations and suggest specific trading ideas. Users can choose sectors and other criteria for a trade, and the idea generator will look for potential trading opportunities.

Of course, the broker offers the usual candidates – stocks, bonds, ETFs, mutual funds and options – but it goes even further. Traders can also find futures and metals (gold and silver) here, and can trade stocks on foreign exchanges as well. Trader Workstation is not a platform for investors who have never used one before. It’s a complex, fully-featured program that feels like it does just about everything.

Structured products and fixed income products such as bonds are complex products that are more risky and are not suitable for all investors. A diverse choice of stocks, mutual funds, bonds, and other financial products are available for trading on the platform. IBKR Lite is geared at novice and retail investors, while IBKR Pro is aimed at more sophisticated traders. Interactive Brokers is generally better for experienced traders and active traders. While Vanguard solely offers its web and mobile platforms, Interactive Brokers provides more advanced trading platforms and tools. Interactive Brokers stands out with its access to 150 international markets.

If you’re the type of trader who enjoys trading on the go, you’ll love IBKR’s comprehensive and responsive mobile app. The app mirrors the full functionality of the brokerage’s desktop trading site, allowing you to browse constantly-updating stock and market data and place buy and https://forexbroker-listing.com/ sell orders. Interactive Brokers even offers the ability to buy fractional shares of stock and was also the 1st major broker to offer this feature. Fractional shares are available on the Toronto Stock Exchange, Cboe Canada and all eligible U.S. and European stocks and ETFs.