In the above formula, the incremental net operating income is equal to incremental revenues to be generated by the asset less incremental operating expenses. Accounting Rate of Return, shortly referred to as ARR, is the percentage of average accounting profit earned from an investment in comparison with the average accounting value of investment over the period. There are a number of formulas and metrics that companies can use to try and predict the average rate of return of a project or an asset. If you’re making long-term investments, it’s important that you have a healthy cash flow to deal with any unforeseen events.

What Is Accounting Rate of Return (ARR)?

The ARR metric factors in the revenue from subscriptions and expansion revenue (e.g. upgrades), as well as the deductions related to canceled subscriptions and account downgrades. ARR—or Annual Recurring Revenue—is the industry-standard measure of revenue for SaaS companies that sell subscription contracts to B2B customers, whereby the plan is active in excess of twelve months. Let’s talk about Annual Recurring Revenue (ARR), a vital financial measurement for businesses that rely on subscriptions, especially in the SaaS field. The initial cost of the project shall be $100 million comprising $60 million for capital expenditure and $40 million for working capital requirements. There are multiple online calculators that can take care of these calculations on your behalf, or you can seek advice from a financial advisor to work out the likely annual profit.

Accounting rate of return method

- The ARR is the annual percentage return from an investment based on its initial outlay.

- Kings & Queens started a new project where they expect incremental annual revenue of 50,000 for the next ten years, and the estimated incremental cost for earning that revenue is 20,000.

- This indicates that for every $1 invested in the equipment, the corporation can anticipate to earn a 20 cent yearly return relative to the initial expenditure.

- While ARR doesn’t give you a completely accurate figure, it can provide a basic snapshot of any investment’s potential earnings over time.

- Deciphering the complexities of Annual Recurring Revenue (ARR) calculation, particularly with discounts and churn, is vital.

There are a total of six components to annual recurring revenue (ARR), which must be analyzed to truly understand the underlying growth drivers and customer engagement rates. The formula to calculate the annual recurring revenue (ARR) is equal to the monthly recurring revenue (MRR) multiplied by twelve months. By spotting these late payers through consistent ARR monitoring, you can maintain the health of your cash flow. Regular accounts receivable aging reports serve as your financial magnifying glass, allowing you to spot habitual late payers. These reports categorize your unpaid customer invoices by their outstanding duration, making it easier to identify late payers.

Accounting Rate of Return (ARR): Definition & Calculation

To calculate the ARR of the SaaS provider on this particular customer, we would divide the contract value ($50,000) by the number of years (4), which comes out to an ARR of $12,500 per year. If your customers pay for installations, these should be considered in your Monthly Recurring Revenue (MRR) instead. Read on as we take a look at the formula, what it is useful for, and give you an example of an ARR calculation in action.

Learning how to calculate ARR helps give you some idea of whether the investment is worth the time, cost, and effort. These calculations are also useful when comparing multiple investments because you can see which will be the most profitable. In today’s fast-paced corporate world, using technology to expedite financial procedures and make better decisions is critical. HighRadius provides cutting-edge solutions that enable finance professionals to streamline corporate operations, reduce risks, and generate long-term growth. Going into more detail, in businesses based on subscriptions, ARR measures the annually committed and recurring revenue.

What are the Advantages of Accounting Rate of Return?

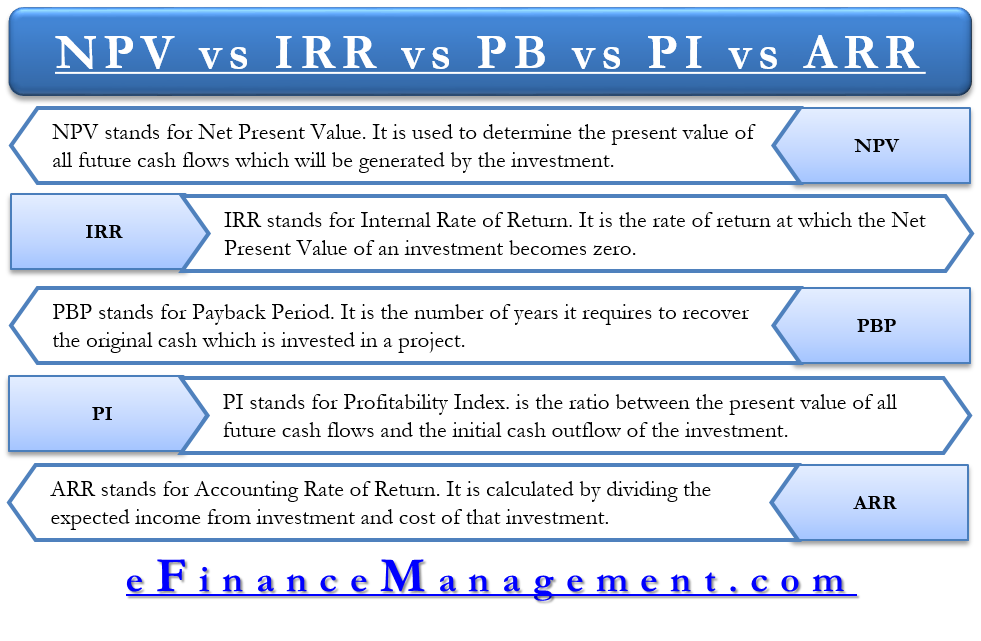

However, it is preferable to evaluate investments based on theoretically superior appraisal methods such as NPV and IRR due to the limitations of ARR discussed below. One of the easiest ways to figure out profitability is by using the accounting rate of return. Average Annual Profit is the total annual profit of the projects divided by the project terms, it is allowed to deduct the depreciation expense. Generally, the higher the average rate of return, the more profitable it is. However, in the general sense, what would constitute a “good” rate of return varies between investors, may differ according to individual circumstances, and may also differ according to investment goals.

They suggest that your company is building momentum and has a secure product/market fit. There are multiple metrics to consider before jumping into any investment, one of which is the average rate of return (ARR). Average rate of return offers a simple way to calculate an investment’s potential for profit or risk. In this guide, we’ll cover how to calculate ARR as well as what to do with this information.

Company A is considering investing in a new project which costs $ 500,000 and they expect to make a profit of $ 100,000 per year for 5 years. Accounting Rate of Return is calculated by taking the beginning book value and ending book value and dividing it by the beginning book value. The Accounting Rate of Return is also sometimes referred to as the “Internal Rate of Return” (IRR). This indicates that for every $1 invested in the equipment, the corporation can anticipate to earn a 20 cent yearly return relative to the initial expenditure.

This practice aids them in understanding the full annual cost of their continuous products or services. Regular ARR calculations are essential as they provide valuable insights into the company’s financial health and growth opportunities. The Accounting Rate of pricing plans Return (ARR) forecasts the likely return on an investment. For example, if a business pours $250,000 into a project, expecting an annual income of $70,000 for five years. You calculate the ARR by dividing the yearly average profit by the initial investment.

Find out how GoCardless can help you with ad hoc payments or recurring payments. This is a solid tool for evaluating financial performance and it can be applied across multiple industries and businesses that take on projects with varying degrees of risk. Very often, ARR is preferred because of its ease of computation and straightforward interpretation, making it a very useful tool for business owners, key stakeholders, finance teams and investors.